Exxon Mobil Corp. (NYSE: XOM), the biggest U.S. oil company, is scheduled to release its fourth quarter 2009 earnings before the opening bell on Monday, February 1, 2010. Analysts, on average, expect the company to report earnings of $1.20 per share on revenue of $83.96 billion. In the year ago period, the company reported earnings of $1.55 per share on revenue of $84.70 billion.

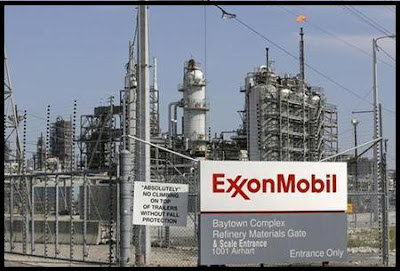

Exxon Mobil Corporation engages in the exploration, production, transportation, and sale of crude oil and natural gas. The company also engages in the manufacture of petroleum products, and transportation and sale of crude oil, natural gas, and petroleum products. It manufactures and markets commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics, and other specialty products.

In the preceding third quarter, the Irving, Texas-based company reported that its third-quarter net income plunged to $4.73 billion, or $0.98 per share, from $14.83 billion, or $2.85 per share, in the year-ago quarter. Total revenues and other income for the third quarter slumped to $82.26 billion from $137.74 billion in the prior year quarter. Analysts, on average, expected the company to report earnings of $1.03 per share on revenue of $79.29 billion.

Upstream earnings declined to $4.012 billion from $10.971 billion in third-quarter , largely due to lower crude oil and natural gas realizations. In Downstream, the company's U.S. operations reported a loss of $203 million, compared to earnings of $978 million last year.

Third quarter oil-equivalent production rose about 3% from last year to 3.69 million barrels of oil equivalent per day, or koebd, from 3.59 koebd in the year-ago period, with contributions from major start-ups including Qatargas 2, Train 5 and Ras Laffan 3, Train 6 in Qatar. Excluding the impacts of entitlement volumes, OPEC quota effects and divestments, production was up about 5%.

In December, the oil giant agreed to buy natural gas producer XTO Energy Inc. (NYSE: XTO) in an all-stock transaction valued at $41 billion. The acquisition is expected to expand its presence in unconventional natural gas industry.

Recently, Exxon Mobil and Brazilian oil giant Petrobras (NYSE: PBR) announced that they are teaming up to explore about 7.4 million acres in the Black Sea offshore Turkey for oil and gas.

At a time when most oil companies are slashing their capital spending due to concerns about capital availability and the price of oil, Exxon has kept its capital expenditure plan intact. The company increased its capital expenditures (investment spending) by 11% in 2009, to $29 billion, and will spend up to $150 billion over the next 5 years.

The company is well positioned to benefit from economic rebound and rising oil prices. Benchmark U.S. crude oil prices rose 12 percent during the fourth quarter and averaged $76 per barrel, up from $68 in the third and $59 in the same quarter a year before.

The company's stock currently trades at a forward P/E (fye 31-Dec-10) of 11.42 and PEG (5 yr expected) of 26.83. In terms of stock performance, Exxon Mobil shares have lost nearly 14% over the past year.

Full Disclosure: None.