Mosaic Co. (NYSE: MOS), one of the world's largest producers of concentrated phosphate and potash, is scheduled to release financial results for the fiscal first quarter 2010 after the closing bell on Monday, October 4, 2010. Analysts, on average, expect the company to report earnings of 72 cents per share on revenue of $1.97 billion. In the year ago quarter, the company posted earnings of 23 cents per share on revenue of $1.46 billion.

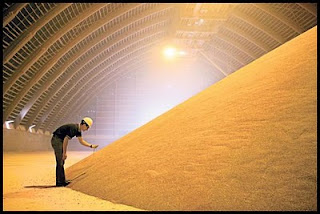

The Mosaic Company engages in the production and marketing of concentrated phosphate and potash crop nutrients for the agriculture industry worldwide. The company serves customers in more than 40 countries. It is leading producer of potash in North America, with nearly 40 percent market share. It is the second-largest global potash producer, with a global market share of 13%. Mosaic is also the world’s largest integrated phosphate producer. Its share of the world phosphate production is 13 percent while its share of the US production is 58 percent.

In the preceding fiscal fourth quarter, the Plymouth, Minnesota-based company's net income was $396.1 million, or 89 cents per share, from $146.9 million, or 33 cents per share, in the year-earlier quarter. Revenue increased to $1.9 billion from $1.6 billion. Analysts, on average, expected the company to report earnings of 87 cents per share on revenue of $2.14 billion.

For first quarter, the company expects total phosphate sales volumes of 2.8 million to 3.2 million tons and an average DAP selling price of $410 to $440 per ton. For the first quarter of fiscal 2011, it anticipates total potash sales volumes of 1.2 million to 1.5 million tons and an average MOP selling price of $300 to $330 per ton.

The company is spending billions to increase its production of both phosphate fertilizers as well as potash. In fact, the company expects to reach an annual production level of 17 million tonnes by 2020. This year Mosaic will spend between $1.0 and $1.2 billion in capital expenditures.

The company is poised to benefit from elevated grain prices, strong Chinese grain demand and rapidly depleting US fertilizer inventories. Last month, grain prices surged to a 52-week high on the back of droughts in China and more recently Russia helping to create new demand for related products such as fertilizer.

Full Disclosure: None.